Home Courses Online M.Com Financial Management

Online M.Com in Financial Management

An online MCom in finance management is one of the most trending specializations of this master’s category. With this online PG degree, you can explore numerous career opportunities in the finance field that are accessible to its on-campus graduates. This recognition is given to this course due to its UGC-DEB approval. This is one of the reasons why this online PG course has become a favourite of finance and accounting professionals. Thus, if you want to get your master’s completed without paying a high fee and without an entrance exam, this course is your perfect match!

Written ByPriya Pandey

Last Updated : 26-01-2026

Course Duration :2 Years

Overview of Online M.Com in Financial Management

An online MCom in finance management is a master’s-level course that is offered online with the main focus on the financial aspects of businesses. Since financial management is a key factor for any business, this online program is highly useful for every industry sector. Whether you are a fresh graduate who wants to step into the commerce work field or a professional looking for career growth, this online master’s degree caters to all your needs.

One of the biggest reasons to opt for this online finance program is that it offers all the benefits of a regular MCom program without requiring you step into the university. Yes, with the UGC-DEB-approval, this online master's course is completely valid and brings all the career benefits to you as that of its traditional version. That’s why most of the working professionals and even students opt for it and continue to fulfil their work and personal commitments along with it.

Moreover, the simple eligibility criteria, the entrance exam-free admission process, and an affordable fee range will help you understand the hype of this program among the working class. Furthermore, the high ROI of this online MCom program will also make you understand why this online degree course has a higher number of applicants than its traditional format.

Coming to the curriculum of this online program, you will be surprised to see what it delivers in the flexible 2 years! From covering the basic topics like Managerial Economics, Statistics for Management, Financial Management, Security Analysis, Portfolio Management, Cognitive Analytics, and Social Skills for Professionals to projects and dissertations, this MCom online specialization will make you all set for the industry. This way, upon completion of this course, you will not only have a valid online MCom degree but also the skills that make you justify it!

Why Choose Online M.Com in Financial Management

- Your biggest reason to choose this online finance management course might be the flexibility that it offers. It makes you learn all the theoretical and practical aspects of the finance domain at anytime from anywhere without altering your existing schedule.

- Choose this online master’s program if you want to have it all without making your career suffer! Since this finance management online course is highly flexible and recognized by UGC-DEB, it offers the benefits of a regular MCom program.

- Get enrolled in this online PG degree if you want access to high-paying job roles at a faster rate without serving as an executive for 6-7 years in a firm.

- Select this game-changer online finance course if you understand the current industry trends well enough. Since the recruiters nowadays are more inclined towards skills, they are looking for professionals with real experience, not those who just hold a regular degree.

Who Can Pursue Online M.Com in Financial Management

Fresh Commerce Graduates

Freshers who have just completed graduation in the commerce discipline can apply for this online PG course.

Graduates from Any Domain

Those with an Arts or Science background at the graduation level can also apply for this flexible master’s program.

Finance Professionals

Working professionals in the commerce or finance field who need a master’s degree for career growth but cannot leave their jobs are the best fit for this online program.

Career Switchers

Those who are bored with their current profiles and want to switch their careers to a finance-specific field can also opt for this master’s degree online.

Talk to our Counsellors

Get personalized guidance and support from our experienced counselors. Schedule a free consultation today!

Mayank

Palak

Surabhi

Shoaib

Mayank

Palak

Surabhi

Shoaib

Mayank

Palak

Surabhi

Shoaib

Mayank

Palak

Surabhi

Shoaib

Sudhanshu

Danish

Shirsti

Aman

Sudhanshu

Danish

Shirsti

Aman

Sudhanshu

Danish

Shirsti

Aman

Sudhanshu

Danish

Shirsti

Aman

Key Highlights of Online M.Com in Financial Management

| Key Factors | Details |

| Program Name | M.Com in Financial Management |

| Degree Level | Post Graduate (PG) |

| Duration | 2 years (24 Months) |

| Mode of Learning | Online |

| Approval | UGC-DEB | AICTE | WES | NIRF | NAAC Certification |

| Eligibility |

|

| Fees | ₹ 1 - 5 lakhs |

| Admission | 100% Online |

| EMI Options | Yes, no-cost EMI options available |

| LMS |

|

| Exam |

|

| Acceptance | Widely accepted by Global MNCs and Government Sectors |

| Placement Assistance | Interview Prep | Resume Building | Virtual Job Fairs |

| Top Job Roles | Investment Analyst | Financial Analyst | Internal Auditor | Tax Consultant | Financial Planner | Banking Officer |

| Average Salary | INR 7 - 11 LPA |

| Top Recruiters | Kotak Mahindra Bank | PwC | TCS | ICICI Bank | HDFC Bank | SBI Bank |

Other Specializations of Online M.Com Course

Eligibility Criteria of Online M.Com in Financial Management

To apply for this online MCom major, you need to fulfill the following eligibility criteria:

Indian Applicants:

- Complete your graduation degree from a UGC-recognized university

- Score a minimum of 50 marks in the graduation

- There is no mandate on any particular discipline

- Graduates of 3-year or 4-year degree programs can apply

- A diploma will not be entertained for this master’s program

International Applicants:

- Complete your graduation degree in any domain

- A minimum of 36 months of executive work experience supported by Employer-issued documents is required (this may vary with the university)

- A Certificate of equivalence from the Association of Indian Universities

Growth of Online Education

- Value of Online Degree: UGC-DEB has made it equal in value to a regular degree.

- Market Demand of Online Degree: Forecasted to reach $8.93 billion with a CAGR of 8.6% (2020-29).

- Global Employee Acceptance: 92% Acceptance rate of online graduates by leading global MNCs.

- Salary Hike:Professionals receive a 40-60% salary hike after completing an online degree.

Duration of Online M.Com in Financial Management

The online MCom in finance management course duration is 2 years, which is similar to its regular format. At some universities, you might get an extra period of 2 years, which makes the maximum duration of this course 4 years. This stretched duration accounts for the added flexibility of this online master’s course.

Syllabus & Subjects of Online M.Com in Financial Management

The online MCom in finance management course syllabus is designed to make you well-equipped with the latest tools and techniques that are being used by many organizations globally. The project work and dissertation included in this course curriculum help you get an idea of the real world. This way, you will develop a better vision of handling the ground-level challenges.

The semester-wise course syllabus for this online M.Com is given below for better clarity.

Syllabus of M.Com in Financial Management | |

| Semester - I | Semester - II |

|

|

| Semester - III | Semester - IV |

|

|

Fee Details of Online M.Com in Financial Management

The full course fee for this online MCom in finance management program is between INR 1 and 2 lakhs at reputed private universities. This fee range includes the tuition fee, LMS charges, examination fee (not fixed), and career support services. This way, you not only get a degree at this fee package but also gain industry-ready skills. You might find this online PG program within a range of INR 30,000 to INR 40,000 at some government universities, but the additional services mentioned above will not be available.

EMI starting at ₹6,776/month only

The course fee is ₹2,75,000

Invest in your career

Boost your career growth with an industry-relevant online degree.

Get high ROI by securing high-paying job roles in leading MNCs.

Work Study:Implement framework to upskill without leaving job.

Hands-on modern digital tools to make students job-ready.

Need Easy Payment Plans?

Verify your EMI eligibility and select the best plan with expert support.

EMI & Financial Support for Online M.Com in Financial Management

Learners looking to enroll in the online MCom program can avail interest-free or low-interest loan facilities to minimize the financial burden of course fee payment. Online universities collaborate with an EMI partner that provides no-cost EMI, collateral-free, and hassle-free loan disbursement.

Loan Process - 100% Online

- Fill in Application Form & KYC

- Bank Verification

- E-mandate & Loan Agreement

- Disbursement

Loan Eligibility Criteria

- Age - 21- 59

- Cibil Score - 650+

- Salary - Minimum 20K

- Documents Required - Adhaar | Pan | Last 6 months' bank statement

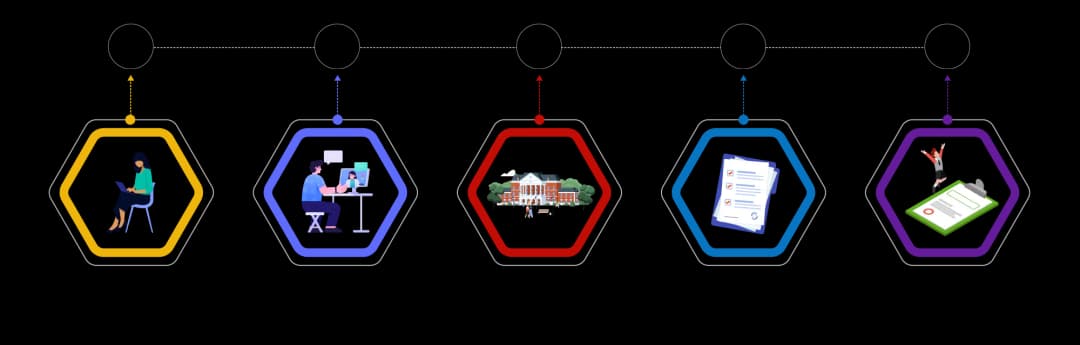

Admission Process of Online M.Com in Financial Management

The university has a simple online M.Com admission process. While the admission may vary as per the university, here are some common step-by-step guides for MCom online admission:

- Registration: Visit the university’s official website and click on Register/ Apply Now.

- Fill Basic Details: Fill your academic, personal, and work experience details.

- Upload Documents: Upload identity proof, academic certificates (X, XII, and Bachelor’s degree), scanned signature, photograph, and work experience letter.

- Pay Program Fee: Pay your online MCom program fee. The university allows multiple payments and No-cost EMI.

- Confirmation from the University: After completing payment and the basic process, wait for admission confirmation within a week from the university.

Note: You will get LMS login credentials via sms or email within 7 days of admission confirmation.

Documents Required for Online M.Com Admission

Given below is a list of some documents required for online MCom admission in India:

| Categories | Document You can Upload |

Academic Certification |

|

| Identity Proof |

|

| Work Experience |

|

| Photo and Signature |

|

Note: While uploading, ensure the documents are in the right format (JPEG, PNG, or PDF) and size as requested.

Not Sure About This Degree?

We'll Help You Choose the Right One With Personalized Guidance!

Is an Online M.Com in Financial Management Worth It?

Yes, an Online MCom in Financial Management is a good move, especially now that skills matter so much for jobs. The financial industry in India is expected to grow a lot each year, so there's a big need for people who know their stuff when it comes to money and risk.

Reports say that most employers think online degrees are just as good as regular ones, as long as they're legit and focus on skills. Plus, jobs like financial analysts are still some of the most wanted jobs in India, which makes this degree a great choice.

When it comes to getting your money's worth, this online PG course is a winner. Freshers with this degree usually begin with decent salaries and can make even more as they get experience. This online M.Com major is cheaper than going to a full-time college and allows you to work while you study. With finance jobs relying more on data, this online finance management course gives students and workers a way to move up in their careers and earn more money down the line. All-in-all it's a smart and forward-thinking decision.

Career Opportunities After Online M.Com in Financial Management

An online MCom in Financial Management is a great way for students and working professionals to boost their finance careers. India's finance world is blowing up, so there's a need for finance pros. Grads can start around ₹3 - 5 LPA, and with some experience and learning, they can jump to ₹8 - 15 LPA.

This course won't break the bank like old-school traditional MCom programs. You can keep working while you study. You'll get real-world skills in things like looking at finances, handling risks, taxes, and how companies handle their money. It's a smart move if you are thinking long-term.

Here is a list of job roles and average salaries that you can get after completing an MCom finance management degree.

| Job Role | Average Salary (INR per annum) |

| Financial Analyst | ₹4 – 8 LPA |

| Investment Analyst | ₹5 – 10 LPA |

| Corporate Finance Executive | ₹4 – 9 LPA |

| Accounts Manager | ₹4 – 8 LPA |

| Tax Consultant | ₹4 – 10 LPA |

| Internal Auditor | ₹3.5 – 7 LPA |

| Banking Officer | ₹3 – 7 LPA |

| Risk Analyst | ₹5 – 9 LPA |

| Business Analyst (Finance) | ₹6 – 12 LPA |

| Stock Market / Equity Analyst | ₹5 – 15 LPA |

| Cost Accountant | ₹6 – 12 LPA |

| Financial Planner | ₹4 – 8 LPA |

| Treasury Executive | ₹5 – 10 LPA |

| Credit Analyst | ₹4 – 9 LPA |

| Finance Manager (Mid-Level) | ₹8 – 15 LPA |

Source: Ambitionbox

Top Recruiters of Online M.Com in Financial Management

After you get your M.Com in Financial Management online, big banks and consulting places like HDFC, ICICI, Axis, Kotak, SBI, Deloitte, KPMG, PwC, EY, JP Morgan, and Goldman Sachs are all looking to hire. They want people for jobs in financial analysis, corporate finance, risk management, auditing, taxes, and investment banking. Your skills as a finance manager will be of good use to them. Thus, there are high chances of you making good money, moving up the career ladder, and getting the name of any of these big companies on your resume with this degree.

Here are some top organizations where you can earn good money after completing the M.Com finance management course.

| Top Recruiter / Company | Typical Average Salary (INR per annum) |

| HDFC Bank | ₹4 – 9 LPA |

| ICICI Bank | ₹4 – 9 LPA |

| Axis Bank | ₹4 – 8 LPA |

| Kotak Mahindra Bank | ₹4.5 – 9 LPA |

| Citi Bank | ₹7 – 18 LPA |

| Barclays | ₹6 – 16 LPA |

| Goldman Sachs | ₹10 – 25 LPA |

| Morgan Stanley | ₹9 – 22 LPA |

| Tata Consultancy Services (TCS) | ₹4 – 8 LPA |

| SBI (State Bank of India) | ₹3.5 – 7 LPA |

| Yes Bank | ₹3.5 – 8 LPA |

| Mahindra Finance | ₹3.5 – 8 LPA |

| ICICI Securities | ₹5 – 12 LPA |

| Aditya Birla Group | ₹5 – 10 LPA |

| HDFC Life | ₹4 – 8 LPA |

Source: Ambitionbox