Online M.Com Course

The Online M.Com is a 2-year postgraduate program that has been the first choice for students after completing B.Com. The MCom course helps students strengthen their core concepts in finance, accounting, economics, and management. The course program can be accessed digitally from anywhere. After completing the MCom degree online, students can work as a financial analyst, accountant, or business consultant in major banks, fintech, and stock-broking firms.

Written ByAkram Raja

Last Updated : 25-02-2026

Course Duration :2 Years

Overview of Online M.Com Course

The online Master of Commerce (M.Com) is an advanced PG program for students and working professionals to gain in-depth knowledge in business management, finance, and accounting. The 24-month course curriculum is split into four semesters. The UGC-DEB and AICTE accredited the MCom online course in India for providing career-oriented programs.

The Online M.Com degree aims to strike a balance between theoretical and practical skills through deep insights into finance, accounting, economics, management, taxation, real-world case studies, and masterclasses by experts from fintechs, auditing firms, and market leaders.

This online PG program in commerce helps working professionals to learn financial skills and implement them simultaneously. It also offers workshops on the latest changes in laws and regulations from leading regulatory bodies, like the GST Council, FICCI, IMF, World Bank, and SEBI.

Additionally, the demand for online MCom has experienced a surge of 74% among working professionals and fresh graduates who are looking to become finance-savvy to make their mark on Fintech, digital commerce, and analytics.

The demand for M.Com online programs has been surging due to their flexible, self-paced curriculum, allowing students to pursue them from anywhere. The curriculum follows the latest trends, including Fintech, Digital Commerce, Sustainable Finance, Blockchain, AI, Cybersecurity, and Regulatory Compliance. These specialize in online MCom to help students evolve according to upcoming market trends.

Why Choose Online M.Com Course

An online M.Com course has some unparalleled benefits over its traditional counterparts:

- Convenience: Students have 24/7 access to live lectures, e-books, masterclasses, and real-world accounting case studies. The webinars and exams are mainly conducted online to ensure work-life balance.

- Cost-effective: The Online MCom course has a lower tuition and saves money on commuting expenses and related utility bills, ensuring a positive balance sheet. The Online MCom fees may vary from ₹ 40,000 to ₹ 2 lakhs, depending on the university and specialization you choose.

- Balance Personal and Professional Skills: The curriculum strikes a perfect balance between technical skills, like finance, accounting, business taxation, and soft skills, like problem-solving, communication, and strategic planning, to boost your self-confidence.

- Networking Opportunities: An online university conducts regular events, workshops with fintech leaders, and collaborates with financial management firms to connect with peers, alumni, and recruiters.

Online M.Com vs Regular M.Com vs Distance M.Com

| Factor | Online MCom | Distance MCom | Regular MCom |

| Mode |

|

|

|

| Cost |

|

| ₹ 1 to ₹ 5 lakhs |

| Interaction and Support |

| Face-to-face interaction with faculty and peers |

|

Top Affordable Universities for Online M.Com Courses

Here’s the list of some top online universities you should prefer for an Online MCom program:

| Universities | University Accreditations |

| Manipal University Online | UGC-DEB, NAAC A+, AICTE, WES |

| LPU Online | UGC-DEB, NAAC A++, NIRF, THE World University Ranking |

| Amity University Online | UGC-DEB, NAAC A+, QS World University Ranking, WES, DEC, WASC, QAA (UK) |

| Sikkim Manipal University Online | UGC-DEB, NAAC A, NIRF, AICTE, WES, QS World University Ranking |

| Jain University Online | UGC-DEB, NAAC A++, AICTE, QS World University Ranking |

| Sharda University Online | UGC-DEB, NAAC A+, AICTE, ARIIA, QS World University Ranking |

Who Can Pursue Online M.Com Course

Working Professionals

Working professionals who want to strengthen their knowledge of financing, accounting, taxation, and explore new opportunities.

A Fresh Graduate

Who wants to gain real-world insight and kickstart their career in fintech and commerce-related firms.

Entrepreneurs

Seeking to improve their financial management skills in accounting, mathematics, regulatory laws, taxation, and related fields.

Government Job Aspirants

Who are looking for a flexible course to strengthen their knowledge on budget, banking rules, economics, and related skills while preparing for government jobs.

Talk to our Counsellors

Get personalized guidance and support from our experienced counselors. Schedule a free consultation today!

Mayank

Palak

Surabhi

Shoaib

Mayank

Palak

Surabhi

Shoaib

Mayank

Palak

Surabhi

Shoaib

Mayank

Palak

Surabhi

Shoaib

Sudhanshu

Danish

Shirsti

Aman

Sudhanshu

Danish

Shirsti

Aman

Sudhanshu

Danish

Shirsti

Aman

Sudhanshu

Danish

Shirsti

Aman

Key Highlights of Online M.Com Course

| Key Factors | Details |

| Program Name | Online Master of Commerce (M.Com) |

| Degree Level | Post Graduate (PG) |

| Duration | 2 Years (4 Semesters) |

| Mode of Learning | 100% Online |

| Approval to be considered | UGC-DEB | AICTE | WES | NIRF | NAAC Certification |

| Top Specializations |

|

| Eligibility |

|

| Fees | ₹ 40,000 - ₹ 2 Lakhs (Full Fees) |

| Affordability | More cost-effective than an on-campus MCom |

| EMI Options | Yes, No-cost EMI options available |

| Admission Process | 100% Online |

| Payment Options | UPI, Debit Card, Netbanking, Credit Card, No-cost EMI, Bank Transfer |

| LMS |

|

| Exam Mode | Online Mode |

| Job Acceptance | Widely accepted by Global MNCs and Government Sectors |

| Placement Assistance |

|

| Top Job Roles | Financial Analyst | Risk and Research Analyst | Auditor | Chartered Accountant | Investment Banker | Accounting Manager | Company Secretary | Finance Consultant |

| Average Salary | Fresher Avg: ₹4 - 8 LPA Experienced Avg: ₹12 - 30 LPA |

| Top Recruiters | EY | Paytm | Razorpay | ICICI | HDFC | JP Morgan | Amazon | PayPal | KPMG | Goldman Sachs |

Specializations of Online M.Com Course

Eligibility Criteria of Online M.Com Course

Here are some of the common eligibility criteria for MCom online programs in India:

- Student: Bachelor's degree from a recognized university/institution (BCom preferred)

- Working Professionals: 10+2+3 degree from a university/institution (math or economics as one subject is preferred)

- CA Aspirants who have completed or are in the final year of the CA certification course by ICAI (Institute of Chartered Accountants of India)

Growth of Online Education

- Value of Online Degree: UGC-DEB has made it equal in value to a regular degree.

- Market Demand of Online Degree: Forecasted to reach $8.93 billion with a CAGR of 8.6% (2020-29).

- Global Employee Acceptance: 92% Acceptance rate of online graduates by leading global MNCs.

- Salary Hike:Professionals receive a 40-60% salary hike after completing an online degree.

Duration of Online M.Com Course

The duration of the online M.Com course in India is 2 years, divided into 4 semesters of six months each. Additionally, UGC allows learners to extend their course duration up to 4 years in case of failure or any other unavoidable circumstances.

The university conducts 100% online exams and assessments at the end of every semester.

Syllabus & Subjects of Online M.Com Course

The university offers multi-specialization options for online M.Com programs in India, like blockchain, account management, and more. The curriculum is divided into four semesters and follows a similar subject pattern for the first two semesters, focusing on key concepts, like data interpretation, balance sheet calculation, taxation laws, and regulatory compliance.

However, the curriculum for semesters III and IV relies on deeper concepts and real-world cases of specialization, including accounting, finance, strategic management, and business management.

Given below is the semester-wise Online M.Com program syllabus:

Semesters-wise Subject of Online MCom | |

| Semester-I | Semester-II |

|

|

| Semester-III | Semester-IV |

|

|

Fee Details of Online M.Com Course

The online M.Com fee in India ranges between ₹ 40,000 to ₹ 2 lakhs, depending on the university status and specialization you prefer.

A government college offers an online MCom starting from ₹ 20,000, while pursuing it from a top-notch private university might cost around ₹ 1,50,000/-.

The online university has a lower tuition fee, eliminating travel costs, university infrastructure costs, and related bills, which can save you around 50-60% compared to the traditional MCom course.

Students can pay full-time, yearly, or semester-wise course fees using net banking, UPI, education loans, and credit cards. Online university also offers exclusive scholarships and No-cost EMI options to further make the course fee more affordable.

Top Online M.Com Universities in India with Fees

Given below are the Online MCom course fees at the top universities in India:

| Top Universities for Online MCom | Full Fees | Per Sem Fees | EMI Available (No-cost) |

| Manipal Online M.Com | ₹1,08,000 | ₹27,000 | Yes |

| Amity Online M.Com | ₹1,20,000 | ₹30,000 | Yes |

| LPU Online M.Com | ₹81,600 | ₹20,400 | Yes |

| Sikkim Manipal Online M.Com | ₹75,000 | ₹18,750 | Yes |

| Jain Online M.Com | ₹1,10,000 | ₹27,500 | Yes |

| Sharda Online M.Com | ₹1,40,000 | ₹35,000 | Yes |

Note: Online M.Com fees, scholarships, and no-cost EMI may vary based on payment method, available seats, and specialization.

EMI starting at ₹5,500/month only

Invest in your career

Boost your career growth with an industry-relevant online degree.

Get high ROI by securing high-paying job roles in leading MNCs.

Work Study:Implement framework to upskill without leaving job.

Hands-on modern digital tools to make students job-ready.

Need Easy Payment Plans?

Verify your EMI eligibility and select the best plan with expert support.

EMI & Financial Support for Online M.Com Course

Learners looking to enroll in the online MCom program can avail interest-free or low-interest loan facilities to minimize the financial burden of course fee payment. Online universities collaborate with an EMI partner that provides no-cost EMI, collateral-free, and hassle-free loan disbursement.

Loan Process - 100% Online

- Fill in Application Form & KYC

- Bank Verification

- E-mandate & Loan Agreement

- Disbursement

Loan Eligibility Criteria

- Age - 21- 59

- Cibil Score - 650+

- Salary - Minimum 20K

- Documents Required - Adhaar | Pan | Last 6 months' bank statement

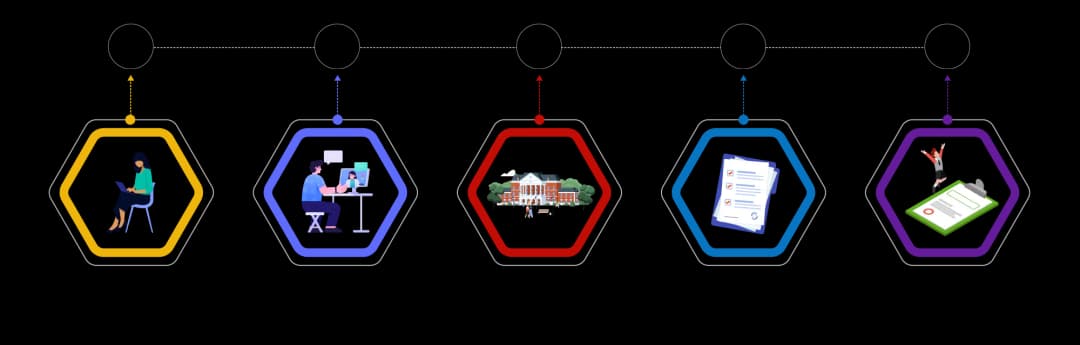

Admission Process for Online M.Com Course

The university has a simple online M.Com admission process. While the admission may vary as per the university, here are some common step-by-step guides for MCom online admission:

- Registration: Visit the university’s official website and click on Register/ Apply Now.

- Fill Basic Details: Fill your academic, personal, and work experience details.

- Upload Documents: Upload identity proof, academic certificates (X, XII, and Bachelor’s degree), scanned signature, photograph, and work experience letter.

- Pay Program Fee: Pay your online MCom program fee. The university allows multiple payments and No-cost EMI.

- Confirmation from the University: After completing payment and the basic process, wait for admission confirmation within a week from the university.

Note: You will get LMS login credentials via sms or email within 7 days of admission confirmation.

Documents Required for Online M.Com Admission

Given below is a list of some documents required for online MCom admission in India:

| Categories | Document You can Upload |

Academic Certification |

|

| Identity Proof |

|

| Work Experience |

|

| Photo and Signature |

|

Note: While uploading, ensure the documents are in the right format (JPEG, PNG, or PDF) and size as requested.

Not Sure About This Degree?

We'll Help You Choose the Right One With Personalized Guidance!

Is an Online M.Com Course Worth It?

An M.Com online degree combines digital learning flexibility, credibility, and real-world skills to ensure you get a balanced career path.

- Customized Learning Path: Online courses are equipped with SLMs (Self-learning modules). Whether you prefer a personalized or pre-assigned timeline, it will help students create a self-paced curriculum that suits their learning style.

- Career-focused Curriculum: It is curated with the latest curriculum, real-world cases, and training from industry leaders in business management, accounting, taxation, and regulatory compliance.

- Trending Specializations: The online MCom curriculum focuses on market trends, like fintech, digital commerce, sustainable finance, blockchain, and AI, to help students stay updated and ready to convert clicks to credit on the go.

- Current Insight on Regulatory Laws: The course also prioritizes real-time updates on regulatory laws and insights related to finance and taxation, GST council, MCA, SEBI, RBI, and IMF, and updates on rules and regulations.

- Implement While Learning: A working professional can study, work, and succeed without a pause by learning real-time projects, case studies, and accounting updates that help them hone new skills and turn numbers into insight on the go.

- Government Job: Students pursuing an MCom Online degree are preferred for major government jobs, like banking manager, income tax officer, compliance auditor, AAO, IPS, IRS, and other finance-related roles in Railways, SSC, and PSUs.

- Salary Hike: Working professionals are experiencing an average salary hike of up to 40% after completing a career-approved online MCom course.

Career Opportunities & Job Roles After Online M.Com Course

Students after completing an online MCom degree in India can secure various government and private jobs in business management, banking, regulatory bodies, accounting, taxation, analytics, and stock management firms.

The M.Com Online degree focuses on a career-supporting curriculum and updated finance and accounting-related laws issued by national and international bodies.

- Learn GST updates from industry experts

- Case studies by the IMF/World Bank reports

- SEBI & RBI financial compliance workshops

Additionally, online universities also offer placement assistance, mock interviews, and masterclasses with industry experts to ensure a smooth transition from tax codes to corporate codes.

A talented individual can secure a package of:

- Fresher: ₹4–8 LPA

- Experienced: ₹12–30 LPA

The average salary depends on the skills and experience they possess. In recent times, working professionals have seen a hike of up to 40% in their pay cheques.

Job Profiles with Salary After Online M.Com Program

The table below contains the list of Online MCom job profiles and average package:

| Job Roles | Average Package |

| Financial Analyst | ₹ 4–16 LPA |

| Investment Banker | ₹ 5-15 LPA |

| Company Secretary | ₹ 4-18 LPA |

| Accounting Manager | ₹ 10–40 LPA |

| Trade Finance Consultant | ₹ 4–25 LPA |

| Chartered Accountant | ₹ 10–25 LPA |

| Research Analyst | ₹ 3.6–18.8 LPA |

| Risk and Compliance Executive | ₹ 4–7.5 LPA |

| Project Manager | ₹10–31 LPA |

| Finance Auditor | ₹ 4-12 LPA |

| Entrepreneur/Founder | Variable |

Source: Ambition Box

Top Recruiters of Online M.Com Course

Whether banking finance services, an audit firm, insurance firms, an education firm, government bodies, or IT and consulting. Online M.com graduates are preferred by MNCs, startups, corporations, consulting firms, e-commerce, and fintech for their talent and unmatched skills.

The table below contains the list of Online M.Com’s top recruiters:

| Top MNCs Recruiters | Average Package |

| Paytm | ₹ 4-22 LPA |

| EY | ₹ 6–30 LPA |

| Amazon | ₹ 5–21 LPA |

| Razorpay | ₹ 6–20 LPA |

| HDFC Bank | ₹ 4–15 LPA |

| ICICI | ₹ 5–24.8 LPA |

| SBI | ₹ 4–21 LPA |

| PayPal | ₹ 7– 40 LPA |

| KPMG India | ₹ 5–20 LPA |

| IBM | ₹ 5–12 LPA |

Source: Ambition Box

Top Employers in Demand