Home Courses Online MBA BFSI (Banking, Financial Services & Insurance)

Online MBA in Banking, Financial Services & Insurance (BFSI)

An online MBA in BFSI is one of the most opted specialisations by banking and finance professionals. This 2-year-long online PG course is equipping individuals with all the digital banking tactics in a highly flexible manner without interrupting their busy schedules. The UGC-DEB recognition of this online course has made it equivalent to a regular one, which helps applicants get their master’s done without making many changes to their daily routine. In addition to that, the updated curriculum and an affordable fee range of this MBA online program make you industry-relevant in this competitive time.

Written ByPriya Pandey

Last Updated : 27-01-2026

Course Duration :2 Years

Overview of Online MBA in Banking, Financial Services & Insurance (BFSI)

An online MBA in BFSI is a master’s program that helps you get really good at how banks work, how to handle money, insurance, and other similar stuff. Since it's all online, you can learn and still keep your job or do other things. It mixes basic MBA topics, like management and marketing, with special BFSI-oriented topics

The curriculum of this course is made to help you understand how banks and other firms work in the real world, especially online. You'll study things like banking, how companies handle their money, keeping things safe and legal, checking out investments, insurance, and new tech in money. The program focuses on making smart choices, looking at money stuff, and leading well so you can handle money products, customers, and rules in the BFSI world.

An online MBA in BFSI is UGC-DEB-approved. Thus, after you complete it, you will be ready for management and analyst jobs at banks, finance companies, insurance places, tech companies, and consulting groups. With online learning being so easy and the courses being about what's hot in the industry, this program is great if you want to get ahead, change to a finance job, or become a boss in the growing banking and finance world.

74% of BFSI Firms Use AI, but Leadership Still Demands an MBA

AI is not just limited to tech anymore; it's a big deal in banking and finance everywhere. In 2025, more than 74% of banks and financial companies have reported that they use AI to spot fraud, handle risks, automate customer service, and figure out credit scores. AI has made customer response times way faster (by up to 70%), fraud detection more accurate (by 90%), and loan approvals quicker (by over 40%). About 60–70% of these firms are actually using AI for real work, not just thinking about it. AI systems now deal with tons of customer chats and watch loads of transactions around the globe.

An online MBA in Banking, Finance, Services, and Insurance gives you skills in the field and helps you lead. That mix is super important now that AI is everywhere. AI can give you info, but you need a person to figure out what it means for money plans, rules, and what customers want. That's what an MBA teaches you. Also, using AI means having leaders who can help teams change and make sure tech stuff fits with business plans. You need to know how all the parts work together, money stuff, risks, what customers do, and tech. Old-school traditional MBA degrees don't always teach you that.

Moreover, in India, people still think that getting money-related advice from a human is more trustworthy than any kind of tool or software. Several studies have even backed up this statement by showing that most students and clients want a real person to make the call, even with all the AI stuff going on. Thus, AI adoption in the BFSI sector is not eliminating jobs but shifting them more smartly.

Why Choose Online MBA in Banking, Financial Services & Insurance (BFSI)

- To Get Jobs in a Booming Field: Banking, finance, insurance, fintech, and online payments are still looking for good managers, analysts, and leaders, both here in India and everywhere else. An online MBA in BFSI will help you make the best out of this industry trend.

- AI Can't Do Everything: Even though AI is taking over some boring tasks, the BFSI world still needs people who can handle risk, make smart plans, follow the rules, and keep customers happy. These jobs need someone who can make MBA-type decisions.

- Learn While You Earn: The online MBA setup means you can get better at your job without quitting. You get to learn and gain experience at the same time.

- Better Pay and a Better Career: An MBA online in BFSI can help you land a better-paying management or specialist job compared to starting in finance.

- Learn What Matters: This MBA online course teaches you about how banks work with money stuff, handling risk, insurance, fintech, and data analysis, basically all the skills you actually need for BFSI jobs.

- Become a Leader: Besides learning about finance, you'll also learn how to lead, talk to people, and think strategically, all things you need for those high-level BFSI positions.

Top Affordable Universities for Online MBA in BFSI Courses

| Universities | Universities Accreditations |

| LPU Online | UGC-DEB, NAAC A++, NIRF, AICTE, WES, SACSCOC |

| Jain University Online | UGC-DEB, NAAC A++, AICTE, AIU, WES, NIRF, QS Word Ranking |

Who Can Pursue Online MBA in Banking, Financial Services & Insurance (BFSI)

Recent College Passouts

Anyone with a bachelor's degree in any field (like arts, business, science, engineering, or management) from a government-approved university can enrol to this course.

Field-specific Professionals

People working in banking, finance, insurance, and similar areas who want to move up or become leaders can opt for this MBA online program.

Career Changers

For professionals in sales, operations, data, or IT who want to switch to management jobs in the banking and finance world, this MBA online specialisation is a perfect fit.

Aspiring Managers & Leaders

If you are aiming for roles such as bank manager, financial analyst, relationship manager, risk manager, or finance consultant, this program is highly useful for you.

Talk to our Counsellors

Get personalized guidance and support from our experienced counselors. Schedule a free consultation today!

Mayank

Palak

Surabhi

Shoaib

Mayank

Palak

Surabhi

Shoaib

Mayank

Palak

Surabhi

Shoaib

Mayank

Palak

Surabhi

Shoaib

Sudhanshu

Danish

Shirsti

Aman

Sudhanshu

Danish

Shirsti

Aman

Sudhanshu

Danish

Shirsti

Aman

Sudhanshu

Danish

Shirsti

Aman

Key Highlights of Online MBA in Banking, Financial Services & Insurance (BFSI)

| Key Factors | Details |

| Program Name | MBA in Banking, Financial Services, and Insurance (BFSI) |

| Degree Level | Post Graduate (PG) |

| Duration | 2 years (24 Months) |

| Mode of Learning | Online |

| Approval | UGC-DEB | AICTE | WES | NIRF | NAAC Certification |

| Eligibility |

|

| Fees | ₹ 1 - 5 lakhs (Full Program Fees) |

| Admission | 100% Online |

| EMI Options | Yes, no-cost EMI options available |

| LMS |

|

| Exam |

|

| Acceptance | Widely accepted by Global MNCs and Government Sectors |

| Placement Assistance | Interview Prep | Resume Building | Virtual Job Fairs |

| Top Job Roles | Risk Manager | Investment Banker | Insurance Manager | Credit Analyst |

| Average Salary | INR 5 - 8 LPA |

| Top Recruiters | Paytm | Pearson | EY | Accenture | EXL | Tally | Globe Toyota |

Other Specializations of Online MBA Course

Eligibility Criteria of Online MBA in Banking, Financial Services & Insurance (BFSI)

- Complete your bachelor’s in any discipline from a UGC recognised university

- Score a minimum of 50% marks in the same

- Work experience is not compulsory, but it would be beneficial for better course understanding

Notes:

- If you have completed the Company Secretary (CS) from the Institute of Company Secretaries of India (ICSI), you will not be asked for any proof of your UG degree

- In case you have qualified as a Chartered Accountant (CA) from the Institute of Chartered Accountants of India (ICAI) or completed Cost & Management Accountancy (CMA) from the Institute of Cost Accountants of India (ICAI), you will be exempted from the above eligibility criteria.

Growth of Online Education

- Value of Online Degree: UGC-DEB has made it equal in value to a regular degree.

- Market Demand of Online Degree: Forecasted to reach $8.93 billion with a CAGR of 8.6% (2020-29).

- Global Employee Acceptance: 92% Acceptance rate of online graduates by leading global MNCs.

- Salary Hike:Professionals receive a 40-60% salary hike after completing an online degree.

Duration of Online MBA in Banking, Financial Services & Insurance (BFSI)

The two-year length of the online MBA program in BFSI is equivalent to that of a standard MBA program in any specialty. But you have a lot more flexibility throughout these two years! If you are a student, you can start a full-time or part-time employment during this time, or you can continue working as a professional, which is not possible with a standard MBA program.

Syllabus & Subjects of Online MBA in Banking, Financial Services & Insurance (BFSI)

The online MBA in BFSI course curriculum is quite interesting. It presents a perfect balance of financial management, accounting, and fintech topics. From theoretical concepts to advanced AI tools, you will get your hands on everything you need to excel in the BFSI domain.

The semester-wise curriculum for this Online MBA degree in BFSI is given below:

Syllabus of MBA in Banking, Financial Services, and Insurance(BFSI) | |

| Semester - I | Semester - II |

|

|

| Semester - III | Semester - IV |

OR Course from the Generic Elective basket 1, which was not chosen above. |

|

Fee Details of Online MBA in Banking, Financial Services & Insurance (BFSI)

The cost of an online MBA program in BFSI cannot be generalised because it depends on a variety of elements that change depending on your preferences. The kind of university you select is the most crucial of them all! The overall cost of this course at a government university is generally less than INR 1 lakh; at private universities, the cost would be slightly higher, ranging between INR 1 and 2 lakhs. Your career may be significantly impacted by this minor variation in the fee structure. Therefore, think about how your choices will affect your future rather than focusing on the affordable MBA degree options!

Top Online MBA in BFSI Universities in India with Fees

| Top Universities for Online MBA in BFSI | Full Fees | Per Sem Fees |

| LPU Online MBA in BFSI | ₹1,61,600 | ₹40,400 |

| Jain University Online MBA in BFSI | ₹2,20,000 | ₹55,000 |

EMI starting at ₹5,500/month only

Invest in your career

Boost your career growth with an industry-relevant online degree.

Get high ROI by securing high-paying job roles in leading MNCs.

Work Study:Implement framework to upskill without leaving job.

Hands-on modern digital tools to make students job-ready.

Need Easy Payment Plans?

Verify your EMI eligibility and select the best plan with expert support.

EMI & Financial Support for Online MBA in Banking, Financial Services & Insurance (BFSI)

Students can avail a collateral-free, No-cost EMI option to reduce the financial burden on the online MBA program fee. Most online universities collaborate with a banking partner that provides no-cost EMI and hassle-free loan disbursement. It includes minimal documentation, eligibility criteria, a 100% online process, and instant disbursement to make the career-aligned course accessible with ease.

Loan Process - 100% Online

- Fill in Application Form & KYC

- Bank Verification

- E-mandate & Loan Agreement

- Disbursement

Loan Eligibility Criteria

- Age - 21- 59

- Cibil Score - 650+

- Salary - Minimum 20K

- Documents Required - Adhaar | Pan | Last 6 months' bank statement

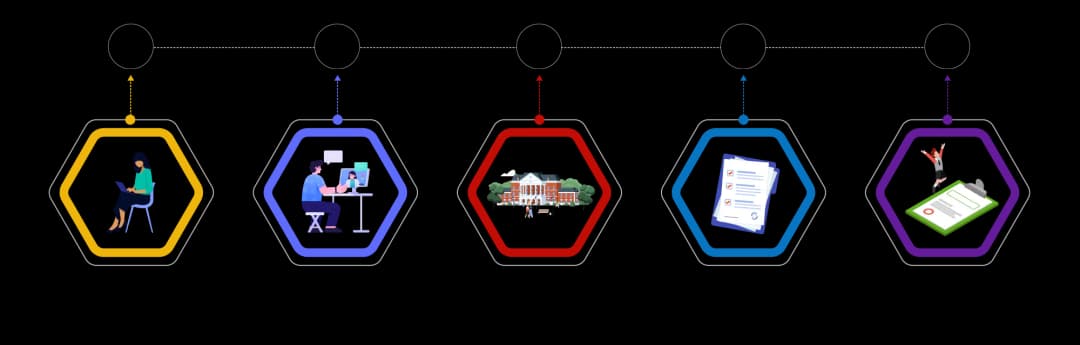

Admission Process of Online MBA in Banking, Financial Services & Insurance (BFSI)

The university has a simple online MBA admission process. While the admission may vary as per the university, here are some common step-by-step guides for MBA online admission:

Step 1- Registration:

- Visit the university’s official website and click on Register/ Apply Now.

- Fill in basic details, mobile number, email, and download the brochure for your preferred course.

- Pay Registration Fee

Step 2 - Application Form:

- Fill in your academic, personal, and work experience details.

- Make sure to verify your details before submitting.

Step 3 - Upload Documents:

Upload scanned copies of:

- Identity Proof: Aadhar, PAN, Visa/Passport (International Students)

- Academic certificate: X, XII, and a Bachelor’s degree

- Scanned signature, photograph

- Experience or Offer Letter (Preferred by some online universities)

Step 4 - Pay Program Fee:

- Pay your online MBA full program/semester-wise/annual fee

- The university allows multiple payments and No-cost EMI

Step 5 - Admission Confirmation

- After completing payment and the basic process, wait for admission confirmation.

- The student will get confirmation within 24 hours of submission via SMS and e-mail.

Step 6 - Get LMS Credentials:

Students will get their LMS login credentials and ID-cards via sms and email after admission confirmation.

Documents Required for Online MBA Admission

Given below is a list of some documents required for MBA online admission in India:

| Categories | Document You can Upload |

| Academic Certificate | 10th | 10+2 | Bachelor’s Degree |

| Identity Proof | Aadhar | PAN | Passport/ Visa (International Students) |

| Work Experience | Offer Letter | Experience Letter |

| Photo and Signature | Passport-size photo | Scanned Signature |

Not Sure About This Degree?

We'll Help You Choose the Right One With Personalized Guidance!

Is an Online MBA in Banking, Financial Services & Insurance (BFSI) Worth It?

Yes, getting an Online MBA in BFSI can be a good move, especially now, since the finance field is changing so fast. BFSI is still a huge job market, both in India and everywhere else. There's a big need for managers who know everything about how to manage money and can make smart choices. Even though technology, especially AI are taking over some of the boring tasks, you still need people with good judgment, leadership skills, and business smarts that this online MBA helps build. Companies really want professionals who can figure out complicated financial statements, handle risks, lead digital changes, and match what the company does with the latest rules and what's happening in the market.

Doing an MBA in Banking, Financial Services, and Insurance course online is even better because it's flexible! You don't have to quit your job to get the degree. That means you can start using what you learn right away, get experience, and meet people in the business. People who graduate with a BFSI MBA usually move up faster in their jobs. They might become risk managers, relationship managers, financial analysts, or leaders in a branch or office. So, if you want to grow your career and stay important in the finance world, an Online MBA in BFSI gives you the know-how and skills to do well, making it a smart thing to do for your future.

Career Opportunities After Online MBA in Banking, Financial Services & Insurance (BFSI)

With the boom of digital banking systems and fintech, the career scope for the BFSI grads is highly promising. With all the latest tool knowledge and methodologies learned from an online MBA in BFSI course, you can turn your dream career into a reality. Your expertise in risk management, data analytics, investment banking, and regulatory compliance will make recruiters fall for you all over again!

Here is a list of some of the job roles that will be accessible to you after this course, and the average annual package offered to them.

| Job Role | Average Annual Salary (₹ per annum) |

| Bank Manager / Branch Manager | ₹10 – 15 LPA |

| Relationship Manager (Banking) | ₹6 – 10 LPA |

| Credit Analyst / Credit Manager | ₹6 – 10 LPA |

| Risk Analyst / Risk Manager | ₹7 – 18 LPA |

| Investment Banker | ₹10 – 20 LPA |

| Financial Analyst | ₹6 – 12 LPA |

| Equity Research Analyst | ₹7 – 15 LPA |

| Corporate Finance Manager | ₹10 – 20 LPA |

| Wealth Manager | ₹8 – 14 LPA |

| Insurance Manager | ₹6 – 12 LPA |

| Treasury Manager | ₹9 – 16 LPA |

| Compliance & Regulatory Manager | ₹7 – 13 LPA |

| Loan Processing / Operations Manager | ₹5 – 8 LPA |

| MIS / Business Analytics Executive (BFSI) | ₹6 – 9 LPA |

| Finance Officer / Executive | ₹5 – 8 LPA |

Source: Naukari.com

Top Recruiters of Online MBA in Banking, Financial Services & Insurance (BFSI)

The digital transformation in the banking and insurance field has created a significant demand for skilled BFSI professionals. Due to this demand, recruiters are hiring these professionals at a high salary package that not only makes them achieve their business goals but also satisfies the candidates’ professional desires.

Here is a list of some organisations that have hired BFSI professionals at pretty good salary packages.

| Recruiter / Company | Average Annual Salary (₹ per annum) |

| Ascentrik Research Services | ₹5 L – ₹8 L |

| Bureau Veritas Consumer Products Services | ₹7 L – ₹12 L |

| Paytm | ₹9 L – ₹11 L |

| Pearson | ₹8 L – ₹11 L |

| Accenture | ₹9.5 L – ₹12.5 L |

| Synmac Consultants Pvt. Ltd. | ₹6 L – ₹9 L |

| EXL | ₹11 L – ₹14 L |

| Rosso Brunello & Da Milano | ₹10 L – ₹12 L |

| EY (Ernst & Young) | ₹12 L – ₹15 L |

Source: Naukari.com

Top Employers in Demand